UNVEILING HIDDEN TREASURES: THE APPEAL OF ABANDONED HOUSES FOR SALE IN AUSTRALIA

Across Australia’s vast landscape, from historic inner-city suburbs to the quiet reaches of the outback and coastal towns, abandoned houses for sale present a blend of history, challenge and possibility. Often constructed with distinctive architectural details—from colonial weatherboards to mid-century brick veneers—and sited in established neighborhoods, these properties can reward buyers who are prepared to invest in restoration. This article examines why homes fall into disuse, the legal and planning hurdles purchasers may encounter, and the realistic renovation and economic opportunities these neglected properties can offer.

The Allure of Hidden Opportunities in Australian Property

Abandoned houses in Australia present a distinctive kind of opportunity for discerning buyers. Unlike typical market listings, these properties often come with a story, a history etched into their very foundations. Their appeal lies not just in the potential for a lower purchase price, but in the scope for creative restoration and the chance to add significant value through renovation. This segment of the market can attract a diverse group of individuals, from seasoned renovators and property developers to first-time buyers looking for a challenge and a way to enter the property ladder in a unique manner. The process often involves navigating legal complexities, understanding structural issues, and envisioning a property’s future beyond its current state of disrepair.

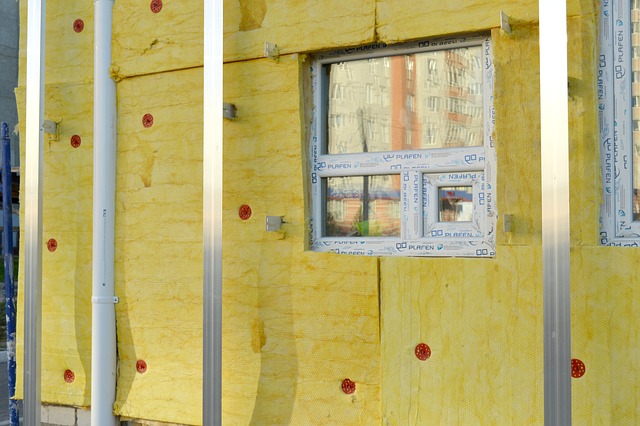

Showcasing Untapped Potential in Neglected Australian Homes

Many neglected homes, despite their current appearance, possess underlying potential that can be unlocked with strategic investment and effort. This might include desirable locations, robust original construction, or unique architectural features that are rare in modern builds. A property that seems derelict might sit on a sizable block of land, offer views that have been obscured by overgrown foliage, or be situated in an area poised for future growth and development. The transformation of such a property can not only result in a comfortable and modern living space but also contribute positively to the aesthetic and value of the surrounding local community. Identifying this untapped potential requires thorough inspection and a creative mindset.

Economic Shifts Impacting Australian Real Estate

The landscape of Australian real estate is continuously shaped by various economic shifts, which in turn influence the availability and appeal of abandoned properties. Factors such as interest rate fluctuations, changes in lending policies, and shifts in regional economies can lead to properties being left vacant or falling into disrepair. For instance, a downturn in a specific industry in a regional town might lead to an exodus of residents, leaving properties behind. Conversely, periods of strong economic growth and urban expansion can drive up land values, making even derelict properties in desirable locations attractive for their land component alone. Understanding these broader economic trends is crucial for anyone considering an investment in abandoned homes.

Urbanization’s Impact on Australian Property

Urbanization plays a significant role in the dynamics of abandoned properties across Australia. As populations centralize in major cities and coastal hubs, some regional areas or older city fringe suburbs might experience a slower pace of development or even decline, leading to properties being left vacant. However, the reverse can also be true: rapid urban sprawl can engulf previously quiet areas, turning abandoned properties into prime real estate for redevelopment. Government infrastructure projects, rezoning efforts, and community revitalization initiatives can dramatically alter the prospects of neglected homes, transforming them from liabilities into valuable assets. This interplay between urban growth and property neglect creates a constantly evolving market for these unique opportunities.

Understanding Costs and Market Realities of Abandoned Properties

Investing in an abandoned property involves a clear understanding of financial commitments beyond the initial purchase price. The overall cost encompasses not only the acquisition but also significant expenses related to renovation, repairs, permits, and potential holding costs during the restoration period. These costs can vary widely depending on the extent of damage, the property’s size, its location, and the desired level of renovation. It is essential for potential buyers to conduct thorough due diligence, including professional building inspections and detailed cost estimates for all necessary work, to avoid unexpected expenses. Market realities dictate that while the purchase price might be lower, the total investment often reflects the effort required to bring the property up to a livable or marketable standard.

| Product/Service | Provider | Cost Estimation (AUD) |

|---|---|---|

| Property Inspection (Pre-purchase) | Local Building Inspector | $500 - $1,500 |

| Basic Renovation (Minor repairs) | Local Builders/Tradespeople | $20,000 - $80,000 |

| Major Renovation (Structural work) | General Contractor/Architectural Firm | $100,000 - $400,000+ |

| Demolition & Site Clearance | Local Demolition Services | $10,000 - $50,000 |

| Legal Fees (Conveyancing, permits) | Property Lawyers/Council | $1,500 - $5,000 |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

In conclusion, abandoned houses in Australia represent a multifaceted opportunity for those willing to look beyond initial appearances. The appeal stems from the potential for value creation, the charm of historical properties, and the strategic advantages offered by various economic and urban development trends. While the journey of acquiring and renovating such a property comes with its own set of challenges and financial considerations, the reward of transforming a neglected structure into a vibrant home or a profitable asset can be substantial for the prepared and patient investor.